1. Do I Need Travel Insurance for Vietnam?

Many international visitors come to Vietnam and ask if it is Mandatory to Purchase Travel Insurance in Vietnam.

The answer depends; this was not mandatory by the law. However, it is to help you to enjoy your trip to the fullest.

Although Vietnam is a pretty safe country, traveling to a foreign country may involve many unexpected accidents. A good travel insurance will cover the unexpected and ease your worries.

This is a very common question for tourists.

The insured

Foreigners entering Vietnam for tourism, sightseeing, vacation, visiting friends, attending conferences, seminars, congresses, sports competitions, performing arts, working individually or collectively go in an organized group and have a predetermined program.

2. Travel Insurance with Other Insurance

Travel insurance is different from other insurance in many ways.

First, it is intended to offer medical coverage when you are in a foreign country. The medical coverage is often short-term within a specific destination and period. In this case, the destination is Vietnam.

Second, it covers various risks that a traveler may encounter, including:

- Trip delays or cancellations

- Baggage loss, theft, or damage

- Thefts of personal belongings

- Personal liability

There are even more cases that travel insurance may cover. However, it often does not cover pre-existing medical conditions or post-travel.

3. How Much Does Travel Insurance Cost In Vietnam?

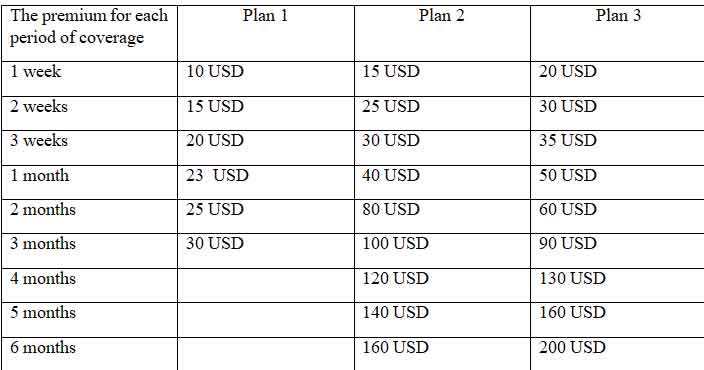

The cost of a good Vietnam travel insurance plan varies depending on many factors, including your home country, the length of your trip, and what you want the insurance to cover.

For example, an American adult can expect to pay $ 60 - 80 for a 1-week standard travel insurance plan. Of course, more coverage means higher prices, so you should consider this factor carefully.

This is the price list of travel insurance in Vietnam. If you have any more questions, please feel please to contact us.

4. Where To Buy Travel Insurance for Covid in Vietnam?

Many companies in the world and Vietnam provide this service, such as Bao Viet, Bao Minh, HSBC, Prudential, Chubb life, and Cathay Life. Each company has different services with different prices and different coverage. Here is some example.

4.1. Bao Viet

Bao Viet is a prestigious insurance company in Vietnam. It offers an international travel insurance plan with three tiers, including Silver, Gold, and Diamond. Each program has different coverage.

4.2. Chubb Life

Chubb provides extensive travel coverage in the ‘Worldwide Travel Protection Plan. The plan covers emergency medical assistance, personal accident, baggage, and personal effects, trip assistance, and personal liability.

The travel insurance holders also have access to a global support network that can provide a referral service if you get sick overseas.

4.3. HSBC

HSBC Insurance (Vietnam) is owned by Hong Kong and Shanghai bank. Provide a lot of different travel insurance services for travelers from Bronze, Silver, Gold and Diamond with reasonable prices and benefits.

4.4. Travel Agencies

Many travel agencies collaborate with insurance companies to provide their tourists with travel insurance packages. It will be more convenient as you do not need to buy separate travel insurance.

For example, Go Viet Trip works with many insurance companies to provide the best price and services for all tours in Vietnam.

There are many options for you

5. What’s Covered With Our Travel Insurance to Vietnam?

It will depend on the company, the price and the package you buy will cover different benefits. Here are some primary benefits

-

Bodily injury or accidental death

-

Sickness or non-accidental death

-

The baggage loss or damage causes fire, explosion, vehicle collision, collision, sinking, overturning.

-

Loss of checked baggage according to the baggage trip

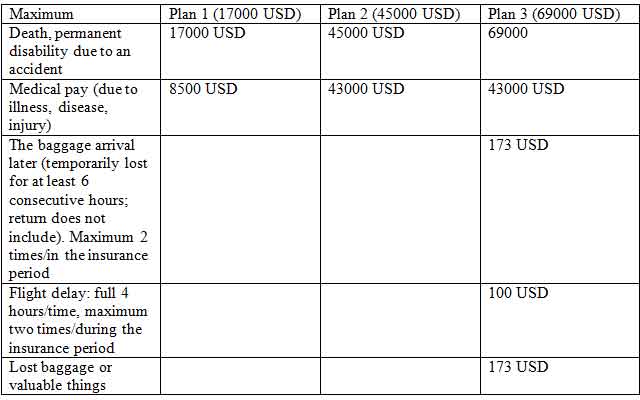

Here is example

Cathay Life has three tiers: Silver, Gold, and Platinum.

The Silver plan only covers medical injuries, while Gold and Platinum also cover flight delays, cancellations, baggage lost or delays, emergency medical evacuation, repatriation of mortal remains, and terrorism.

Hopefully, you find this article helpful, and your trip to Vietnam goes well, and you never need your coverage, but traveling without it and you could risk more than it costs of the policy. Make sure you have travel insurance for Vietnam.

If you have any questions, please do not hesitate to contact us via Email: Goviettrip@gmai.com or hotline +84968667589. We are guarantee about quality and prices. Get a full refund if you do not feel happy with our services.

Author Hoan Nguyen

He has over 10 years of experience working in the tourism sector and operator. He has traveled to many places in Vietnam and around the world.

Photos: Go Viet Trip, Internet